A Global Presence

About Equity Derivatives

Our Equity Derivatives team creates and issues a wide range of solutions that enable institutional and individual clients to achieve their targeted equity exposure to individual stocks or indices as part of their investment or hedging strategies. We meet clients’ specific requirements, including on their ESG positioning, through innovation at a product level and by developing bespoke underlying indices. Natixis CIB serves financial institutions directly and distributes to individuals through private and retail banks, including through the Banque Populaire and Caisse d’Epargne networks in France.

Our Financial Engineering and Sales work as an unified team to develop innovative solutions through the below 8 pillars.

Indices

Natixis is now recognised as a key provider of Passive Investment Strategies. Over the years, Natixis has been developing a new generation of indices combining the same degree of transparency as traditional equity indices.

Alternative Risk Transfer (ART)

The ART initiative is our capability to identify and transform hard-to-shift risk into profitable trades for institutional clients (Pension Funds, Insurance Companies, Asset Managers).

Global Securities Financing (GSF)

GSF employs delta-one strategies to facilitate equity exposure, hedging, strategic acquisitions, collateralised financing or bespoke portfolio solutions. It enables clients to optimise their equity portfolios, providing liquidity and the opportunity to extract incremental yield on assets and/or cash.

Equity Payoffs

We develop innovative structured solutions focusing on boosting returns and protecting capital to meet investors’ specific risk and return profiles. We are one of the leaders in providing overlay hedging strategies to Pension Funds and Insurance Companies based on their regulatory constraints.

Fund Solutions

Fund Solutions offers a full range of fund-linked products to clients globally. The team’s mandate includes Capital Protected and Leveraged Products, Pass Through and Regulatory Solutions, as well as Financing Solutions.

Hybrids

By combining asset classes, it allows our clients to simultaneously diversify risk and also purchase their hedges at a lower cost as we actively risk manage exposures across asset classes.

Wrapper & Regulatory Solutions

By understanding the regulatory constraints of our clients, we provide efficient wrapping solutions:

- Actively Managed Certificate (AMC)

- Special Purpose Vehicle (SPV)

- EMTN

- Warrants

- OTC

Marketing

The Marketing Solutions team provides high quality services that range from the complete production of commercial brochures to the development and implementation of digital learning platforms tailored to client requirements and also their branding.

About Natixis

Natixis is the international corporate and investment banking, asset management, insurance and financial services arm of Groupe BPCE. Listed on the Paris stock exchange, Natixis has a number of areas of expertise that are organized into four main business lines:

- Corporate & Investment Banking

- Asset & Wealth Management

- Insurance

- Specialized Financial Services

+18,000 Employees

+18,000 Employees

Natixis Investment Managers

15th largest asset manager in the world(1)

Assets under management(2): €802.1bn

(1) Cerulli Quantitative Update: Global Markets 2018 – ranking based on AuM as of December 31, 2017

(2) Net asset value as of December 31, 2018

Long-term ratings

| Rating agency | Long term |

|---|---|

| Standard & Poors | A+ (stable) |

| Moody's | A1 (stable) |

| Fitch | A+ (stable) |

Results

as of December 31, 2019Net revenues(1)

€9.196bn (+5% vs. 2018)

Net income (gs) restated (1)

€1.897bn (45% vs. 2018)

(1) Excluding exceptional items

Financial structure

as of December 31, 2019Basel 3 FL CET1 capital(1)

€11.2bn

Basel 3 FL CET1 Ratio(1)

11.3%

(1)Based on CRR-CRD4 rules as reported on June 26, 2013, including the Danish compromise – no phase-in.

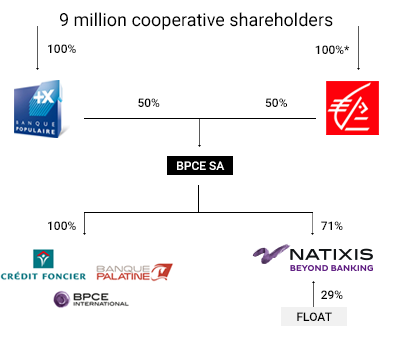

About Group BPCE

50 countries

105,000 Employees

30 Million customers

Figures as of December 31, 2018Groupe BPCE pursues a full range of banking and insurance activities, working through its two major Banque Populaire and Caisse d’Epargne cooperative banking networks and through its different subsidiaries.

Groupe BPCE offers its customers a comprehensive range of products and services: savings and investment solutions, cash management services, financing solutions, insurance, and wholesale banking services. Faithful to its status as a cooperative banking institution, the Group accompanies its customers in the realization of their different projects and develops long-lasting relationships with them, thereby contributing 20% to the drive to finance the French economy.

Organization chart

As of December 31, 2017

*Indirectly through Local Savings Companies

Results

As of December 31, 2019Net revenues income(1)

€24.305bn

Attributable Net income(1)

€3.030bn

(1) Excluding non-economic and exceptional items

Financial structure

As of December 31, 2019CET1 ratio(2)

15.6%

TLAC Ratio(2)

23.3%

(2) Estimate at Dec. 31, 2019 – CRR/CRD IV without transitional measures; additional Tier-1 capital takes account of subordinated debt issues that have become ineligible and capped at the phase-out rate in force

Group Internal Guarantee & Solidarity System

What is the guarantee and solidarity mechanism

• Pursuant to Article L.511-31 of the French Monetary and Financial Code (Code monétaire et financier), BPCE shall, as the central institution, take any measures necessary to guarantee the Financial Code (Code monétaire et financier), BPCE shall, as the liquidity and solvency of Groupe BPCE.

• Natixis, in its capacity as an institution affiliated with BPCE, is covered by the Groupe BPCE financial solidarity mechanism.

How does it work ?

In the event Natixis encounters financial difficulty,

• BPCE would firstly provide support using its own regulatory capital in accordance with its duty as a shareholder;

• should this prove insufficient, it would use the mutual guarantee fund created by BPCE, which at December 31, 2016 totaled €362.6 million in assets provided jointly by the Banques Populaires and Caisses d’Epargne networks, and which is increased through an annual contribution (subject to the amounts which would be used in the event of a call for funds);

• if BPCE’s regulatory capital and this mutual guarantee fund should prove insufficient, BPCE would call on (in equal proportions) both the Banques Populaires and Caisses d’Epargne networks’ own guarantee funds of €900 million in total and;

finally

• if calls on BPCE’s regulatory capital and these three guarantee funds should prove insufficient, additional sums would be requested from all Banques Populaires and Caisses d’Epargne.

It should be noted that the guarantee funds referred to above consist of a Groupe BPCE internal guarantee mechanism activated at the initiative of the BPCE Executive Board or the French banking regulator, which may request that it be used if deemed necessary.

Consequences

• Financial failings of Natixis SA (like all affiliated French Regulated Credit Institutions, the “FRCI”) would be covered by the aggregate capital of the 2 networks.

• This explains that there is only 1 credit risk and 1 senior debt rating for all the FRCI within the group (excluding CFF with S&P). Bondholders are ultimately protected by the aggregate capital of the 2 networks.

Want to find out more ?

Contact Natixis directly by email or call your area sales contact